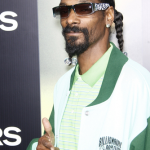

Rapper and pop culture icon Snoop Dogg’s affinity for marijuana is as iconic as the star himself. His latest foray into cannabis has led to him to raise an impressive $45 million for marijuana investments, according to High Times.

In 2015, Snoop founded Casa Verde Capital, a venture fund that specializes in, as High Times puts it, “the parts of the burgeoning cannabis business that don’t actually deal with the plant itself,” or the ancillary parts of the industry. Included under this umbrella are “health, …financial services, technology, media, compliance, and laboratory technology verticals.” Since the company’s founding Snoop has raised a whopping $45 million for the firm’s investments. According to the rap icon’s managing partner, Karen Wadhera, who spoke with Tech Crunch, most of that money came within the last year.

The increasing ease the firm has had raising money is due to mainstream culture’s growing comfort level with cannabis, the firm’s ancillary business model — which allows them to avoid many complications by not touching the plant– and Snoop’s household name, at least according to High Times. Snoop’s partner Wadhera says this is just the beginning.

“We’re writing seed-stage to Series A-size checks, so $1 million plus, with roughly half our fund reserved for follow-on investments, where we can write another $3 million to $5 million,” Wadhera explained. “And we’re only focused on the ancillary part of the cannabis industry, so we won’t invest in companies that touch the plants. No dispensaries or cultivators or manufacturers. We’re investing in the picks and shovels.”

(287)

Leave A Reply